Executive Summary: Defining the New Bio Pharma Supply Chain Strategy

The pharmaceutical supply chain in 2026 faces regulatory, economic, and geopolitical pressures that fundamentally reshape how medicines reach patients globally. The Inflation Reduction Act’s Medicare Drug Price Negotiation Program establishes maximum fair prices 38-79% below 2023 list prices for the first ten drugs, effective January 1, 2026, requiring pharmaceutical companies to recalibrate supply chain investment models under compressed margin structures and develop a robust bio pharma supply chain strategy.

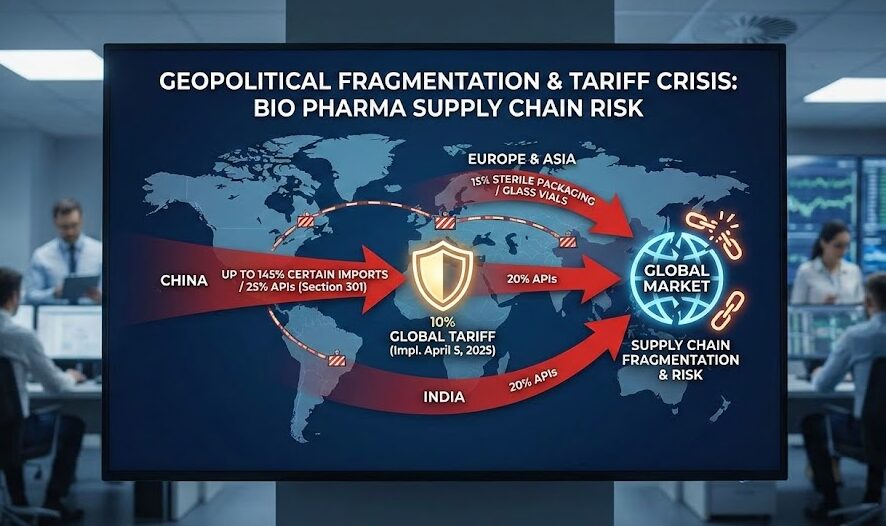

Simultaneously, an unstable tariff environment with up to 145% duties on Chinese pharmaceutical imports and a 10% global tariff implemented on April 5, 2025, shifts focus to domestically sourced supply chains. Furthermore, proposed NIH budget adjustments from $48 billion to $27 billion rebalance the public-private funding mix for therapeutic innovation. Against this backdrop, pharma supply chain challenges intensify as serialization compliance deadlines cascade through 2025-2026:

- Manufacturers and Repackagers: Facing May 27, 2025, requirements.

- Wholesale Distributors: August 27, 2025, deadline.

- Dispensers: Implementation mandated through November 2026.

Policy Transformation and Pharma Supply Chain Consulting Challenges

The Inflation Reduction Act’s (IRA) Medicare Drug Price Negotiation Program establishes government price setting for the first ten drugs, fundamentally altering pharmaceutical economics and creating what industry analysts term a “new Loss of Exclusivity event” independent of patent protection. With negotiated Maximum Fair Prices 38-79% below 2023 list prices, effective January 1, 2026, the entire ecosystem must strategically adapt and alter lifecycle models to maintain operational sustainability under compressed revenue structures.

This timing creates acute pharma supply chain consulting challenges regarding investment schedules:

- Small-molecule drugs: Face price negotiations at 9 years post-approval.

- Biologics: Face negotiations at 13 years post-approval.

This occurs exactly when companies traditionally fund next-generation manufacturing investments, safety stock programs, and supply chain business continuity initiatives. The differential treatment creates what some analysts term the “pill penalty.” This policy design may accelerate industry consolidation, with perspectives divided: companies with sufficient scale can leverage economies created through consolidation to maintain profitability under lower price structures, while smaller biotech firms developing small-molecule therapeutics face earlier price negotiations with insufficient financial runway to absorb margin compression and simultaneously invest in supply chain resilience infrastructure.

Operational Impacts and Pharma Supply Chain Challenges

The IRA’s industry impact manifests across multiple operational dimensions. Manufacturers must recalibrate capital allocation decisions, weighing investments in dual-sourcing strategies, safety stock expansion, and manufacturing capacity against reduced product lifetime revenue projections. The compressed margin environment creates particular pressure on supply chain budgets, presenting significant pharma supply chain challenges:

- Qualifying second-source API suppliers: Costs $200K-$500K per molecule with 6-12 month timelines.

- Safety Stock Maintenance: Maintaining 3-6 month safety stocks ties up $2-$5 million in working capital for commercial biologics.

- Revenue Impact: These investments become increasingly difficult to justify when product revenues are subject to 40-60% reductions at negotiation trigger points.

Supply chain leaders must model breakeven analyses comparing present-value tariff costs over 5-10 year horizons against upfront domestic manufacturing capital requirements.

Lifecycle Optimization in Pharma Supply Chain Management

From a supply chain portfolio management perspective, price negotiations may incentivize manufacturers to streamline product portfolios toward higher-margin therapeutics, potentially accelerating generic market entry for negotiated drugs. This transition creates complex supply continuity considerations where effective pharma supply chain management is critical:

- Manufacturers must maintain production of negotiated products.

- Simultaneously, they must transfer manufacturing technology to generic competitors.

- This process requires 12-24 months of parallel production capacity and quality oversight.

Supply chain leaders must develop transition protocols that ensure uninterrupted patient access while managing the operational complexity of supporting both branded and generic production streams during handoff periods.

Geopolitical Fragmentation and the Tariff Crisis in Bio Pharma Supply Chain Risk

Pharmaceutical supply chains face fundamental restructuring driven by escalating tariffs and geopolitical decoupling. Section 301 tariffs impose up to 25% duties on Chinese pharmaceutical chemicals and APIs, while a 10% global tariff implemented April 5, 2025, affects nearly all imported goods, including packaging materials, analytical equipment, and manufacturing machinery. The complexity deepens with specific levies:

- 145% on certain Chinese pharmaceutical imports.

- 25% on APIs sourced from China.

- 20% on imports from India.

- 15% on sterile packaging materials and glass vials from Europe and Asia.

The bio pharma supply chain risk landscape shifts as these tariff structures create economic incentives for supply chain diversification and domestic manufacturing investment, though implementation timelines create acute transitional vulnerabilities. US import rules treat the API source as the drug’s “country of origin,” meaning Indian-made drugs using Chinese key starting materials—representing approximately 70% of Indian API production—incur Chinese tariff rates despite final manufacturing in India.

Regionalization and Technical Sourcing Barriers

The regionalization imperative extends beyond API manufacturing to packaging components, excipients, and analytical equipment. Sterile vials and prefilled syringes sourced from European and Asian suppliers now carry 15% tariff burdens, increasing fill-finish costs for injectable biologics by 12-18% according to industry analyses. For temperature-sensitive products requiring specialized packaging—mRNA vaccines, CAR-T therapies, biologics—these cost increases compound cold chain logistics expenses that already represent 20-30% of distribution budgets.

Companies must evaluate domestic packaging supplier qualification timelines, assess technical capability gaps for advanced formats like pre-filled syringes and dual-chamber vials, and determine whether domestic sources can meet volume, quality, and regulatory requirements within acceptable timeframes.

Small Biotech Vulnerability and Supply Chain Management in the Pharma Industry

Capital scarcity forces lean strategies that trade resilience for survival. Small biotechs often rely on single-source suppliers despite geopolitical risk, operate just-in-time partnerships with CDMOs offering no inventory buffer against disruptions, and defer serialization compliance investments ($100K-$500K per product line) until absolutely required for market entry. A manufacturing disruption at a single CMO can delay IND filings or BLA/NDA submissions by 6-12 months, potentially exhausting remaining cash runway before reaching commercialization.

Commercial dynamics shift inventory burden upstream as customers increasingly demand 6 months of API warehouse inventory to hedge against geopolitical disruptions. This necessitates sophisticated supply chain management in pharma industry practices to navigate the squeeze:

- Inventory Pressure: Transferring inventory carrying costs and obsolescence risk from buyers to manufacturers.

- Absorption: Large pharmaceutical companies absorb these dual pressures through balance sheet strength.

- Biotech Disadvantage: Small biotechs operating with 12-24 month cash runways cannot simultaneously fund clinical development and qualify backup suppliers.

This creates structural competitive disadvantages that may accelerate industry consolidation as innovative firms seek acquisitions or strategic partnerships to access supply chain scale and financial staying power.

Serialization Compliance: A Bifurcated Regulatory Landscape

The pharmaceutical industry navigates two distinct serialization regimes with different maturity levels and enforcement timelines. The EU Falsified Medicines Directive (EU FMD), enforced since February 9, 2019, represents an established operational baseline requiring 2D DataMatrix barcodes and real-time authentication through the European Medicines Verification System.

In contrast, US DSCSA compliance rolls out through staggered deadlines:

- May 27, 2025: Manufacturers and repackagers’ deadline.

- August 27, 2025: Wholesale distributors’ deadline.

- November 27, 2025: Large dispensers (≥26 pharmacists/technicians) deadline.

- November 27, 2026: Small dispensers deadline.

As wholesale distributors crossed the August 27, 2025 milestone, the focus shifts to dispensers preparing for November 2025-2026 requirements. Setup costs range from $100K-$500K per product line for small to mid-size manufacturers, representing a fixed-cost barrier particularly burdensome for small biotechs with limited commercial portfolios who often rely on CMOs to provide serialization capabilities but must verify CMO readiness in target markets.